Kampachi Farms aims to establish a foothold in federal waters

At 600,000 square miles in size, with coastline along five U.S. states, the Gulf of Mexico may seem like an obvious choice for offshore aquaculture.

Neil Sims, CEO of Hawaii-based Kampachi Farms and longtime proponent of offshore aquaculture, said the region couldn’t be any better.

“You’re a couple of hours drive away from Miami, a couple of hours away from Orlando and you have the entire Eastern Seaboard right there,” he said of a spot his company plans to utilize off the west coast of Florida.

The Gulf is also “the land of tourism,” he said, and not only does that mean the demand for local seafood in the area is high, but the opportunity to familiarize visitors with the practice of fish farming could bode well for the industry. As Sims said, “take them out to the farm site, put a mask and snorkel on them and throw them in the water.”

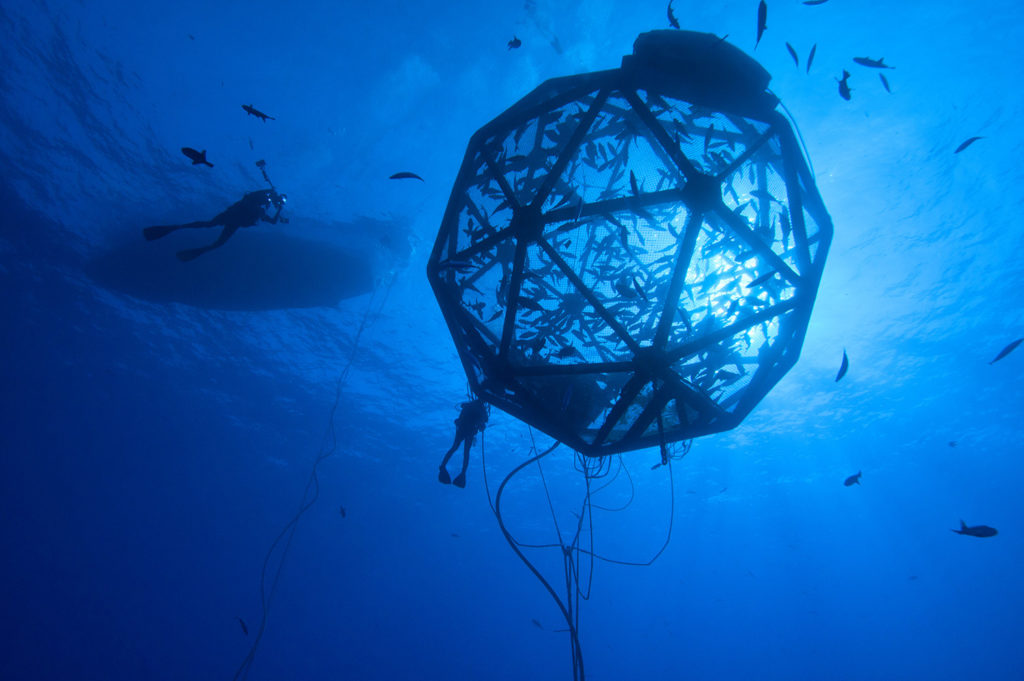

Kampachi Farms is well on its way to becoming the poster child for offshore fish farming in the Gulf. In the coming months, the company will be working with both the University of Florida and the University of Miami to secure a temporary permit to place its submersible, single-point mooring cage system called the Velella Epsilon in the Southeastern waters of the gulf for six to nine months. The experimental pen, funded the National Sea Grant program, will be home for two back-to-back 20,000-fish batches of Almaco jack (Seriola rivoliana), a native species similar to yellowtail and amberjack the company calls “Cabo Kampachi.”

The National Oceanic and Atmospheric Administration (NOAA) sees the potential for offshore farming created a pathway for permitting in the Gulf in 2016, allowing up to 20 operations to be permitted in federal waters there over a 10-year period. But Kampachi Farms is the first company to enter the fray.

That’s largely because the permitting pathway is complex. Sims’ company participated in a trial run a while back that involved working with the Gulf of Mexico Fishery Management Council, as well as the Coast Guard, the Army Corps of Engineers, and the Environmental Protection Agency. Further complicating matters is an ongoing lawsuit brought against NOAA the day after the permitting process was opened up by 11 groups, including a number of regional fishing associations and the Center for Food Safety.

The plaintiffs have essentially argued that NOAA doesn’t have the authority to regulate aquaculture in federal waters under the Magnuson-Stevens Act – the law that governs marine fisheries management in those same waters. But their objections appear to range from concern for wild fish stocks to competition with the local fishing industry.

Sims is aware of these concerns and hopes the experimental site will allow people in the area to get more familiar with offshore aquaculture and pave the way for the larger industry.

“We want to blaze a trail,” he said. “It shouldn’t be this difficult and it won’t be. Once we have regulators that have gone through the process with us and have come out and seen our operations in the water, they’re going to be much more willing to support other projects.”

“We were very cognizant of the need to have community support for something like this,” added Sims. Kampachi Farms has tested both a drifter cage system and a single-point mooring system 6 miles off the shore of Hawaii’s Big Island, and both were “phenomenally popular with the local fishermen” because they acted as giant fish aggregating devices (FADs).

“When our permit was over, we were obligated to pull the pens out of the water. And we had fishermen coming up and pleading with us not to take the pens out of the water. ‘It’s the best fishing I’ve had my life,’ they told me.”

As Michael Rubino, director of the Office of Aquaculture at NOAA’s Fisheries Service sees it, the lawsuit has probably held back investors from seriously considering investing in offshore aquaculture in the Gulf. But he sees offshore aquaculture in the United States as one in a number of ways to scale up domestic fish production. Nearshore marine aquaculture, ponds and recirculating systems will all be part of the mix, he adds.

Rubino points to the fact that Americans are being asked to double their seafood intake from one meal to two meals a week.

“That’s another 6 million tons of seafood [a year]. Where are we going to get that?” he asked. Rather than see U.S. offshore aquaculture as competition, he said, fishermen could be working with seafood farmers to co-market and bring back local seafood to regional markets to compete with the massive quantities of seafood – 91 percent of the U.S. seafood supply is imported – not being produced domestically. “That’s the real competition,” Rubino said.

“A lot of the seafood that we import is from parts of the world with rapidly developing middle classes. And some of that seafood is starting to stay there rather than come here – or may soon only be available at a higher price. So China, India, and other countries are beginning to eat our lunch,” added Rubino. This fact alone should be a compelling reason to start raising more seafood closer to home, he said.

Another challenge has been the Gulf itself – which is already home to many fishing and tourism boats, and a robust oil and gas industry, as well as a number of sensitive ecosystems. With all these factors in play, the thought of siting an offshore farm there has likely been daunting for some companies.

In an effort to help surmount that hurdle and streamline the permitting process, NOAA recently launched the Gulf AquaMapper, a web-based mapping tool that allows its users to get a visual and spatial lay of the land (and water) in the Gulf.

“We’re really working to try to support NOAA’s and the department of Commerce’s vision to grow sustainable aquaculture in the U.S.,” said James Morris, an ecologist at NOAA’s National Centers for Coastal Ocean Science.

The tool will provide a “one-stop shop” for entrepreneurs and scientists looking to explore the idea of siting offshore fish farms, providing a view of everything from shipping lanes, pipelines and submarine tables, to military zones.

“Coastal ocean is a very busy place. You look out there and it looks like a vast, open ocean, but that’s not the case. There is literally vast amounts of activity and it varies temporally and spatially. So, we also have to think about what happens in the future. What industries are going to need those resources?” added Morris.

A lot of the seafood that we import is from parts of the world with rapidly developing middle classes. China, India, and other countries are beginning to eat our lunch.

The Gulf AquaMapper could be a small but important step toward making space for more offshore aquaculture in the United States, provided investors can begin to see a clear path toward permitting. And some of that, according to Morris, is just getting the first few farms in the water.

“The first permits are always the hardest ones,” he said.

Halley Froelich, a postdoctoral researcher at National Center for Ecological Analysis and Synthesis who has been evaluating aquaculture sustainability with a focus on offshore operations, is hoping to work with Kampachi Farms to help the company collect and analyze the data gathered during the upcoming experiment in the Gulf. And Sims plans to document the process and make the information available to others who want to follow suit.

“It may be a really great opportunity to study what farms like this could mean in terms of the interaction with other local conflicts like fishers in the area, as well as from the ecological perspective,” said Froelich.

She also points to the fact that the offshore aquaculture industry is moving much slower in the United States than in other parts of the world; Norway, China and Japan, for instance, are all seeing sizable investments in offshore farms. And Kampachi Farms is currently building a hatchery and offshore farm in Mexico’s Sea of Cortez with a plan to bring fish to market by March of 2019.

Froelich said she’s heard frustration from industry players who wants to move into the Gulf but worry about lack of clarity around the path toward permitting. But that, as she sees it, might not be such a bad thing. The scientist compared it to what has happened with fisheries management in the last few decades and said that planning for sustainability now could mean not having to do it retrospectively down the road.

“It’s an uphill battle from an industry perspective. There won’t necessarily be that very rapid growth,” she said. “But it also means there’s going to be a lot more caution and precautionary approaches and maybe that in the end will be better for all of us.”

Follow the Advocate on Twitter @GAA_Advocate

Author

-

Twilight Greenaway

Twilight Greenaway is a freelance writer and editor and a contributing editor to Civil Eats.com.

Tagged With

Related Posts

Intelligence

‘Spatiotemporal patterns’ indicate improving perceptions of aquaculture

A study led by University of California Santa Barbara researchers has found that public sentiment toward aquaculture improves over time, a potentially important development with growing interest in offshore aquaculture.

Responsibility

Do you know offshore aquaculture when you see it?

Researchers have determined that a definition of “offshore aquaculture” was necessary to critically assess the impacts and benefits of moving fish farming operations “slightly farther and slightly deeper” out to sea.

Responsibility

Going deep on offshore aquaculture

Open-ocean aquaculture, the “new kid on the block” in the rapidly growing aquaculture industry, was examined at a California Academy of Sciences event. New contributor Twilight Greenaway reports.

Innovation & Investment

Opinion: Stop offshoring offshore aquaculture

Something must change if the U.S. government hopes to encourage rather than discourage aquaculture, particularly in federal “offshore” waters. Neil Sims says it’s time to stop exporting knowledge, innovation and investment.