Five expert panelists urge identification of the principal impediments to growth of alternative ingredients

Changes in the world’s population and demographics mean we may need to, roughly, double food production over the next 25 years.

However, agriculture currently uses 37 percent of the world’s land, a number we can’t double. Likewise, we’ll not be able to double the productivity of land now cultivated. So while we can state our need succinctly, we can’t address the need with an equally succinct solution.

We don’t know our pathway to an adequate food future. What we do know is that it’s not the pathway we’re on. Our view changes, however, when we redirect our focus from land to sea.

A recent study of aquaculture’s potential paints the picture. Looking at aspects of agronomic, environmental and political imperatives, the authors found that 3 percent of the world’s oceans to be excellent as potential aquaculture sites. Furthermore, they estimate that farming just 0.015 percent of the world’s oceans would produce an amount of seafood equal to what we now capture from the world’s wild fisheries.

The implications are stunning. Were we to farm fish but 0.1 percent of the ocean’s surface we could annually provide more than 65 kg of fish per person in the early 2040s when our population will hit 9 billion.

But to do so we must address how we’ll feed all those farmed fish. Many fish diets contain fish oil and fishmeal to provide the essential omega 3 oils and the proteins needed for fish growth. However, we now harvest the fish that provide fish oil and fishmeal at their sustainable limits – there simply isn’t enough to meet future demand. We need to expanded omega-3 and protein sources for aquaculture to meet its potential.

Further, by taking actions to ensure that our feed ingredients come from environmentally responsible sources, we meet twin goals: We provide ourselves plentiful supplies of seafood and do so with the smallest possible footprint on the resources needed to raise them.

Our glimpse into the future of how we provide these feed ingredients is, at least, a bit murky. There are many possibilities but we haven’t yet transformed them all into useful and efficient real-world practices.

At the Barcelona Seafood Summit, five members of an expert panel discussed how we might shape a sustainable future for aquafeeds. They laid out what they see as the principal impediments that lie between us and that future.

A new business paradigm: The entire value chain adopts innovation

By José Villalón, corporate sustainability director – Nutreco

With the projected surge in demand for food production, the need to produce more protein with fewer natural resources and the need to complement specific constrained ingredients with alternatives, we must earn our social license to grow aquaculture over the next three decades.

I believe the aquafeed industry and its supply chain partners have done well in complementing and reducing dependency on constrained marine resources, although pressure has increased on other commodity resources. As the industry looks at less conventional ingredient solutions, the short-term challenge becomes one of costs.

Our challenge is to change the way businesses adopt and take responsibility for innovation. If we continue to implement innovation of alternative/complementary feed ingredients under the commodity model of supply and demand nobody will move first. We need to create new avenues and relationships to realise these new alternative ingredients solutions.

Consider a scenario where the fish processor/distributor approaches the client, the food retailer or foodservice provider at their buyer meeting. But instead of coming to the meeting alone, the processor is accompanied by the fish-farmer supplier, the feed manufacturer and the innovative alternative ingredient supplier. The entire supply chain present at the retail buyer meeting! Apply open book, cost-plus concepts in that conversation to demonstrate that the incremental cost of supplying a 300-gram, single portion, farmed fish fillet will have no bearing on the consumer’s purchase decision tree.

If the entire value chain sits down at the retailer buyer table and makes the case for innovative solutions by sharing the incremental cost across the entire value chain with back-to-back contracts, then innovation can be easier to operationalize.

The biggest challenge for aquaculture feed in the 21st century is shifting production to the open ocean

By Jason Clay, SVP, markets and food – World Wildlife Fund

The open ocean is the last frontier for food production on the planet. While habitat conversion on land is responsible for most biodiversity loss globally, the open ocean is the only environment where food production has not been attempted at scale. Fishing, climate change and terrestrial runoff have depleted biodiversity in the ocean. Most aquaculture production is on land, but why do we insist on making terrestrial areas aquatic when more than three quarters of the planet is already aquatic?

In fact, most aquaculture production is on land and this will not be allowed to continue if freshwater shortages increase due to climate change. Aquaculture produces more food per hectare than agriculture, livestock or fishing. Aquaculture can also produce more protein per area of production with fewer inputs than terrestrial livestock production.

Open ocean aquaculture is not without risk: improper siting, pollution, benthic impacts, natural resource depletion, labor/safety issues, public perception, market volatility, to name a few. Many of these issues can be addressed, but perhaps the biggest of all is feed, particularly if the most sustainable production involves shifts to lower trophic level species and moving offshore. New feed sources and technologies will be key as will the development and use of new and more meaningful metrics.

Our view of alternative ingredients needs an attitude adjustment

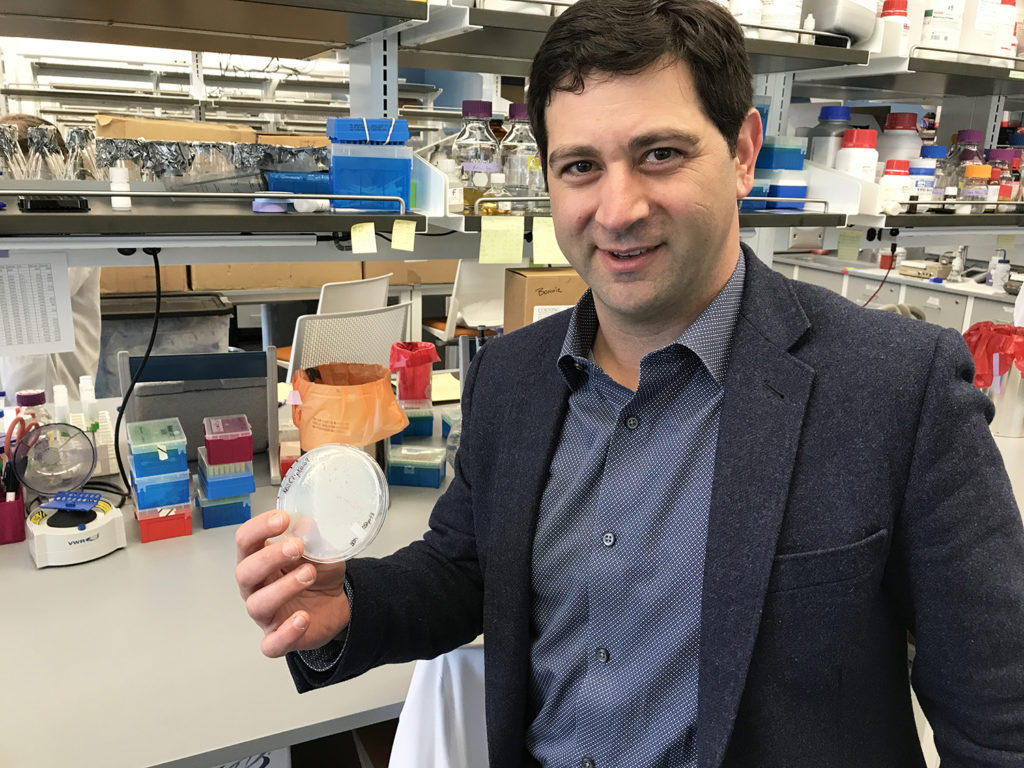

Larry Feinberg, CEO – KnipBio

The incentives are very strong for business-as-usual when it comes to aquafeeds. However, maintaining our course as-is can lead to a lower productivity overall in the future. Fishmeal is the gold standard but is severely supply-constrained. Terrestrial proteins like soy are currently the best (only?) viable alternative we have, but there are “practical diet” limitations, nutritional issues and possibly arable land-availability concerns.

The variety of risks of producing seafood, ranging from disease outbreaks to market-pricing dynamics, is so great that buying lowest-cost feed formulations is one of the few things a farmer can control. As you often get what you pay for, it reinforces that lower yields require lower risk, and therefore lower-cost feeds become systematically preferred. The cross-section between health and proper feed formulation is called immuno-nutrition, and overall yield from the grower (i.e. avoiding disease without using antibiotics) should be quantified for the market to value accordingly.

End-user perceptions distort the ability for the supply chain to adopt emerging ingredients like insects, microbes and genetically engineered ingredients as well. Consumers might be intrigued that their protein was grown using a 1,000-fold more resource-efficient process.

There is little evidence consumers will pay more for such a benefit. We need to make the case that shows clear and tangible benefits to consumers. This is the key to expanding the basket of ingredients to supply the growing aquacultural feed market.

A good story is in danger of being lost in misdirected communication

Lukas Manomaitis, aquaculture program – U.S. Soybean Export Council

I work in the trenches of one of the most exciting livestock industries that exists today – aquaculture – communicating with those involved at every level of the production chain. Perhaps the issue that worries me the most is the tendency of our industry to be too willing to trumpet the idea that we have the solution.

You may have heard this yourself – aquaculture will save the world! Nice concept, but what it has sometimes lead to is confusion and misunderstanding of what aquaculture can do and how it can do it. Take feed ingredients: we have a great story to tell in terms of how efficient aquatic animals are at converting feed to protein. That story is in danger of being lost in the mechanics of that conversation.

The days of “feeding fish to fish to make fish” may be over, but is the answer one amazing ingredient or is it balancing out our formulation approach with ingredients that can target diversity and sustainability? What we lose when different ingredient supporters trumpet that they have the solution to aquaculture feeds is that often this is accompanied by the negatives of other ingredients. We create false expectations, and worse, storylines that place aquaculture in an unflattering light.

Aquaculture needs to move from telling the world that any one ingredient/technology/approach is the one and focus on highlighting how our industry has solutions (plural) to meeting the seafood and protein needs of the future.

We must have consumer demand if we are to drive change

Chris Haacke, global aquaculture lead – Corbion

The aquaculture industry is making good progress towards improving production practices and gaining consumer confidence in the quality of farmed seafood. The sustainability and nutritional attributes of fish feed is not yet a center stage issue for retailers or consumers. Most of us know about grass-fed beef or vegetarian feed for chickens, but do consumers know about what their fish or shrimp have eaten?

Long chain omega-3 fatty acids, typically from marine sources, play an important role in human health, helping support normal brain development and function and lowering the risk of heart disease. One of the primary ways that we get omega-3s in our diet is via seafood (salmon and other oily fish, most notably).

The major source of marine omega-3s today is fish oil. About 1 million metric tons of fish oil are produced each year for aquafeeds, terrestrial animal feed and human nutrition. The aquaculture industry is growing rapidly, but the availability of marine omega-3s from wild caught fish is essentially flat.

Alternatives to fish oil exist today. Microalgae are the original source of marine omega-3s (EPA and DHA) and are at the base of the food chain. Salmon and other finfish eat forage fish and accumulate high levels of omega-3s.

What is preventing the use of microalgae and other alternative ingredients? One primary reason is that consumers are not yet asking the questions – what did my fish eat, is it healthy for me, is the feed sustainably sourced?

Overcoming the challenges

During the panel discussion, several key opportunities emerged that can lead us towards a more sustainable future for aquafeeds. First, there isn’t a lack of potential ingredients for aquafeeds, and the way forward should include the use of many types of ingredients. Just as biodiversity enhances the stability and resilience of ecosystems, if aquaculture operators have access to a diverse set of ingredients, the sector can grow more quickly and in many geographies.

Second, the current business system does not incentivize rapid development and adoption of novel alternative feed ingredients. The supply chain and relationships within the industry are not structured to distribute the costs of changing feed ingredients. This restricts incentives for and speed of novel ingredient development.

Third, pre-competitive dialogues can help accelerate development of multiple alternative ingredients through enhanced communication of the industry’s needs, successes and failures. While these lessons might be learned eventually by emerging companies and innovators, dialogue increases the rate of knowledge transfer and therefor improve the performance of the whole sector

As demand for seafood increases, these lessons can help the aquaculture sector grow through utilization of feed ingredients that increase the profitability, environmental performance and overall resiliency of the sector.

Follow the Advocate on Twitter @GAA_Advocate

Authors

-

Scott Nichols, Ph.D.

Founder & Principal

Food’s Future, LLC[103,114,111,46,101,114,117,116,117,102,115,100,111,111,102,64,116,116,111,99,115]

-

Dane Klinger, Ph.D.

Aquaculture Innovation Fellow

Conservation International[103,114,111,46,110,111,105,116,97,118,114,101,115,110,111,99,64,114,101,103,110,105,108,107,100]

Tagged With

Related Posts

Aquafeeds

A new nutrient for aquaculture, from microbes that consume carbon waste

Biotechnology firm NovoNutrients aims to produce a line of nutraceutical aquafeed additives as well as a bulk feed ingredient that can supplement fishmeal. Its process includes feeding carbon dioxide from industrial gas to a “microbial consortium” starring hydrogen-oxidizing bacteria.

Aquafeeds

Aquaculture feed producer Evergreen wins F3 Challenge

The inaugural F3 Challenge sought to drive innovation in the aquafeed sector and reduce aquaculture's reliance on marine ingredients like fishmeal and fish oil.

Innovation & Investment

Aquafeed ingredient AlgaPrime wins GAA Innovation Award

A proliferation of alternative feed ingredients has allowed aquaculture to extend the natural resources it depends on. AlgaPrime, packed with the long-chain omega-3 fatty acid DHA, is being recognized as a game-changing innovation for aquaculture feeds.

Aquafeeds

The pink powder that could revolutionize aquaculture

KnipBio, a Massachusetts-based biotechnology startup founded in 2013, is refining the manufacturing process for a promising aquaculture feed ingredient that may one day form the foundation of the food that farmed fish eat.