Recap of the 2017 Aquaculture Innovation Workshop

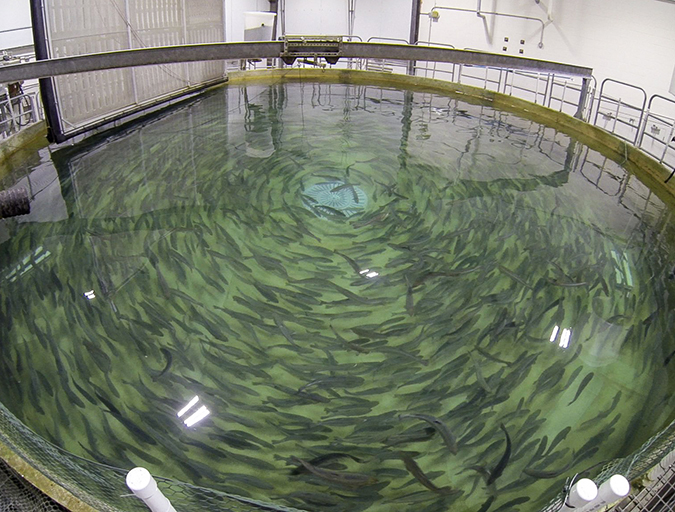

The past five years have created a near-perfect storm of circumstances that has encouraged industry improvements and interest in closed-containment systems. In response to strong and increasing demand for Atlantic salmon, industry is investing in new land-based infrastructure to produce larger post-smolts to stock into ocean pens, and entrepreneurs are investing in producing market-size salmon and trout in recirculating aquaculture systems (RAS) located close to major markets in North America, Europe and Asia.

At The Conservation Fund Freshwater Institute (TCFFI), we believe that finding better methods of seafood production is both an environmental and an economic issue. Sustainable food systems, including seafood, must be more local to nourish people while conserving natural resources and creating jobs within these communities.

And that’s why we have been focusing on the development of sustainable aquaculture production technologies for three decades. Using support from the U.S. Department of Agriculture’s Agricultural Research Service, the Research Council of Norway (CtrlAQUA), industry, nonprofit foundations and other groups, we work to address many of the largest technology challenges facing domestic aquaculture producers. This includes work to reduce capital costs, improve energy efficiency, reduce water requirements, increase nutrient capture and reuse and improve salmonid performance, health, welfare and quality when produced in land-based systems.

The 2017 Aquaculture Innovation Workshop

To dive deeper into the investment, marketing, technical and biological challenges and opportunities of closed containment system in salmonid production, TCFFI – in partnership with Tides Canada, the Atlantic Salmon Federation and Simon Fraser University – organized the 2017 Aquaculture Innovation Workshop (AIW) in Vancouver, British Columbia, from Nov. 29 to 30.

High interest in this timely and relevant “International Summit on Fish Farming in Closed-Containment Systems” – our ninth gathering since 2011 – brought together nearly 185 participants and focused on both floating and land-based systems. The AIW provided an opportunity for aquaculture producers, aquaculture industry suppliers, investors and financial institutions, consultants, scientists and regulators to communicate progress on the technical, biological and economic feasibility of culturing fish – particularly salmon and trout – in closed-containment systems.

Participants hailed from nearly a dozen countries, with major representation from Canada, the United States and Norway. Although there have been many important contributions from other countries, literally spanning the globe, these three countries stood out:

- The United States is a huge market for Atlantic salmon but more than 90 percent of these fish are imported. According to data reported by the National Marine Fisheries Service, Americans consume nearly 500,000 metric tons (MT) annually but produce only about 20,000 MT a year. For America, many think that it’s more important than ever to find ways to domestically increase farmed salmon production. This is a sustainability, economic and food security issue. Investors and entrepreneurs, producers, suppliers, consultants and researchers are supporting the development and application of closed-containment technologies.

- Canada is the 2nd-largest supplier to the U.S. market and Canadian producers have already adopted land-based and floating, closed-containment systems. As in the United States, many stakeholders are supporting the development and application of closed-containment technologies.

- Norway is the global leader in Atlantic salmon production, at nearly 1.3 million MT of annual production. Norway is focused on increasing salmon production in a sustainable manner, potentially to increase five-fold by 2050. They recognize that to approach this target will require a combination of different approaches, including expanded onshore and offshore farming. At the Norwegian Center of Excellence, the CtrlAQUA SFI project kicked off in 2015 with a stated seven-year mission to optimize post-smolt production in closed-systems, so that ocean pen production will be more sustainable and efficient. The AIW participants were fortunate to have nearly a dozen Norwegian scientists and industry partners present on the CtrlAQUA innovations to date. In addition, TCFFI, a co-organizer of the AIW, is a funded research collaborator in CtrlAQUA.

Some 35 experts in closed-containment systems presented. Most of these presentations are available at the AIW website as a PDF of the PowerPoint presentation and/or as a video of the presentation, depending on whether permission was granted by the presenter. A summary of the highlights follows.

The opening keynote speaker (Mark Retzloff, Alfalfa’s Market, USA) and a closing keynote speaker (Fred Haberman, Urban Organics, USA) both described some of their real-world experiences that are required to build an industry in the natural and organic foods sectors.

Opportunities and challenges: Land-based salmon production

After the opening keynote speaker, the first day of the AIW kicked off with three speakers that examined the many opportunities and challenges involved with investing in salmon production in land-based, closed-containment systems: Tone Bjørnstad Hanstad (DNB Markets, Norway), Jon Fitzgerald (Stope Capital Advisors, Canada) and Gary Robinson (GRV Consulting, Canada). These speakers were then joined by Johan Andreassen (Atlantic Sapphire, USA) in a discussion panel on investment and economics of land-raised salmon.

- Tone Bjørnstad Hanstad pointed out that, over the last three years, the salmon farming industry has invested heavily in RAS to increase freshwater capacity for smolts and post-smolts. The development within is driven by the traditional salmon farmers recognition of the technology’s importance for biological control, as RAS is a growth-enabler. She also noted that there were more than 20 projects under development across the globe with plans to produce approximately 150,000 MT fully land-based after 2020.Simply put, the economics are changing; the estimated production costs of salmon in RAS versus open pens are converging, particularly due to significantly increased costs in ocean pens and the increased scale of certain land-based salmon production projects located in markets with transportation cost advantage. In addition, the capital expenses for large RAS is increasingly competitive to the one required for traditional farming in Norway. With the new regulations (traffic light system), roughly 100 NOK investment in license is required per kilogram output alone, in addition to NOK 15 per kg in equipment investment.

- Jon Fitzgerald made the argument that the balance between risk and reward has shifted to the point where professional investors should now consider investing in land-raised salmon businesses. He noted that impact investors were an ideal potential equity partner because the inherent operating risk of all aquaculture is offset, in part, by the more favorable social and environmental profile of land-based systems.Fitzgerald also noted that, in order to attract risk capital, projects must include trained and experienced RAS operators, validated system design and supportive market conditions. Jon stated that “excellence in operations is as rooted in personnel as it is in technology.” The industry faces a shortage of RAS operators due to the rapid expansion of land-based systems across the globe. This challenge was highlighted by many of the producers that spoke later in the AIW.

- Gary Robinson highlight the potential economics of a 3,000 MT per year land-based salmon farm, but noted that he felt that this was the “starter level of production,” as he suggested that the economics in smaller farms would be more challenging. He claimed that the overall economics look very promising “at scale” but there are many ways to do it wrong. Making sure the right team is in place (as well as financing) is the key success factor.

- Johan Andreassen of Atlantic Sapphire (a Norwegian with projects in the USA and Denmark) noted that their experience selling Atlantic Sapphire land-raised salmon suggests that there really is a large market for premium product. There is much more input from Atlantic Sapphire from later presentations.

Updates on land-based and floating salmonid production

Ten speakers from the salmon industry provided updates on their floating and land-based closed-containment systems used for either post-smolt or food fish production.

- Trond W. Rosten, who works in Norway as group manager for research and development at Marine Harvest, described their new approaches to closed-containment. Marine Harvest is using a combination of large, land-based RAS facilities and is testing out floating, semi-closed containment systems for smolt and post-smolt production. He noted that Marine Harvest is probably the world’s largest producer of salmon in RAS. He also explained how the production of a larger post-smolt (potentially even a 1-kilogram fish) would reduce the time required to raise these fish in ocean net pens to just half of the salmon’s life span.In the last 12 years, Rosten claims that Marine Harvest has decreased ocean net pen production time significantly. He thought that post-smolt production would proceed until potentially less than half of the farmed Atlantic salmon’s life was at sea. He also pointed out that improving and developing net pen technology is important to the company. Marine Harvest is a CtrlAQUA industry partner.

- Frode Mathisen, director of freshwater production at Grieg Seafood, discussed the business proposition for land-based production of post-smolts. He noted that in recent years, RAS facilities are being built to provide smolt and post-smolt production; new construction with RAS has largely replaced construction of flow-through systems. Frode thought that a stretch goal would be to reduce the two-year time at sea to just one year, possibly by stocking a near 0.5 to 1 kg post-smolts that (compared to a 100-gram smolt) are potentially more robust at sea and would dramatically shorten the growth cycle at sea, which would reduce risk and potentially allow longer fallow periods. Grieg Seafood is a CtrlAQUA industry partner.

- Sean Wilton of AgriMarine Holdings (British Columbia) described steelhead production to market-size in large, floating fiberglass tanks at Louis Lake in British Columbia. These tanks are operated in a single pass with lake water pumped from a depth selected to optimize the culture temperature.

- Garry Ullstrom and Eric Hobson described progress made with Atlantic salmon production at Kuterra (British Columbia). They described how optimized operations had improved salmon growth and flavor, reduced costs and increased revenues by reducing downgrades at harvest due to sexual maturation; downgrades were less than 2.5 percent with the most recently harvested cohort. Kuterra is one of the first companies to produce market-size Atlantic salmon in RAS, with their first harvest in April of 2014.

- Kirk Havercroft updated us on expansions in the RAS at Sustainable Blue (Nova Scotia). Their most recent expansion, now complete, should double production to approximately 200 MT/year. He said that additional capacity is currently under construction to bring total production up to 500 MT/year. This new expansion is based on a modular technology platform allowing for biological isolation between individual fish tanks. Construction is due to complete in August 2018. They first began harvesting Atlantic salmon in late 2015.

- Justin Henry described Northern Divine’s (British Columbia) work to supply all-female coho salmon eggs and sturgeon caviar and fillets using a combination of flow-through and RAS production. He spoke about finding value in all the parts of the fish and exploring if organic certification can provide value to your farm. Justin highlighted the importance of farming whichever sex is more valuable for any given species of fish. He also reminded producers of the importance of ensuring that their RAS-produced fish are properly finished with an absolutely clean taste when they hit the market.

- Terry Brooks at Golden Eagle Aquaculture (British Columbia) described their production (about 125 MT/year) of coho salmon. He explained that they use RAS to produce a 4.5-pound coho salmon in approximately 16 months.

- Samuel Chen discussed steelhead production at Hudson Valley Fish Farm (New York); their fish have just recently entered the market. He said that they are producing 6- to 7-pound fish in an 18-month production cycle. They are very happy with their harvesting system that electro-stuns the fish after they have gone through the pre-harvest finishing process, and that they have had some positive responses with local marketing. He also emphasized how much effort they have made to identify the best people for his team and need for developing a comprehensive staff training plan.

- Brandon Gottsacker gave an update on Superior Fresh LLC (Wisconsin), which is the first commercial, land-based Atlantic salmon farm in the USA and one of the largest aquaponic production systems in the world. They are already harvesting several varieties of lettuce and expect to produce approximately 1,000 MT of salad greens annually in their raft aquaponic system in a nearly 3-acre glass house. They expect to produce close to 70 MT of fish and currently have multiple cohorts of both Atlantic salmon and rainbow trout under culture in their fish house.They expect to harvest first market size trout (1.7 lbs.) in the spring, with the harvest of their first market-size Atlantic salmon (8-10 lbs.) in the summer. They irrigate the effluent from their fish culture, plant culture and processing systems on over 20 acres of alfalfa but store this effluent in a 5-million-gallon pond when the ground is frozen.

- Johan Andreassen provided an update on Atlantic Sapphire’s “blue house,” i.e., its land-based, Atlantic salmon farms in Denmark and the USA. Their first harvest began in late 2013 at Langsand Laks (Denmark). They harvested salmon until the fall of 2014, when they depopulated and sterilized the farm to eliminate a bacterial-pathogen that likely entered the farm through the seawater intake. After sterilizing the RAS and installing a “firewall” to disinfect the seawater intake, they restocked with Atlantic salmon post-smolt in 2015 and reentered the market with fish in about early 2016. Johan said that this first RAS facility has a production capacity of approximately 800 MT/year.He also discussed their current construction on an expansion to bring Langsand Laks up to approximately 3,000 MT/year. These salmon are marketed in the United States through Platina Seafood, a subsidiary of Atlantic Sapphire. Andreassen also described plans for their new farm near Miami, which has already broken ground on a RAS facility designed to produce near 8,000 MT/year in this first phase of U.S. production, with the first cohort of eyed eggs scheduled to arrive in late 2018. The farm design near Miami (Florida) is rather unique, because it will rely on brackish well water that flows artesian from a depth of over 1,000 feet. Andreassen said that the farm will also rely on re-injecting up to 20 million gallons per day through a 64-inch diameter injection well into the “boulder zone,” which is found at depths of over 3,000 feet. This is the same zone where the state injects municipal wastewater, because the zone contains a very porous limestone. Atlantic Sapphire plans later expansions to 90,000 MT of annual production. Johan estimates that the U.S. market will grow by 8 percent annually and will reach near 1 million MT of annual consumption within 10 years.

Marketing sustainable seafood

The first day of the AIW concluded with three speakers that all focused to highlight compelling market messages for sustainable seafood, particularly when marketing farmed salmon: Guy Dean, Albion Farm and Fish (British Columbia); Jen Paragallo, Fishpeople Seafood (Oregon); Damien Claire, Atlantic Sapphire (Florida).

- Guy Dean, Albion Farms and Fisheries (AFF), explained how they had been processing and marketing Kuterra salmon for the past four years with a goal of distinguishing this salmon from all others while at the same time garnering a premium for this unique product. By developing an extensive marketing and branding program with clear branding attributes, AFF was able to achieve these goals but not without challenges. In his presentation, Guy Dean highlights the key learnings – good, bad and ugly; AFF’s original go-to-market strategy and how it evolved to stay loyal to the brand while at the same time dealing with the biological challenges of this new technology.

- Jen Paragallo of Fishpeople Seafood highlighted several key issues in seafood marketing. She highlighted how old school marketing was driven by supply – we’ve got a lot of this fish, so let’s sell the heck out of it. Today, seafood marketing is going the way of traditional consumer packaged goods and starting with the consumer first. Who are we targeting, what do they want, and how can we deliver them a memorable and differentiated experience, so they’ll come back to our brand time and again?Paragallo also noted that transparency is the way forward. Consumers are demanding it and the seafood industry has an opportunity to move from its traditional “black box” approach to sourcing, which has led to consumer mistrust and confusion, to relentless transparency. Today’s consumers are increasingly interested in the story behind their food, and most seafood companies have a great story to tell about their farmers or fishermen … it’s a missed opportunity to not tell that story. Jen also pointed out that consumers are fearful of seafood for many reasons: It’s difficult to cook and expensive to mess up, and sourcing and sustainability are vague and misunderstood. There is a huge opportunity for all brands to win by educating consumers in an honest and approachable way using the media they most readily consume, i.e., social media.

- Damien Claire, head of sales and distribution, provided an update on Atlantic Sapphire consumer market messages. In a market where the consumer faces many options, the industry continues as a whole to supply more seafood. Atlantic Sapphire offers a unique product with a strong brand promise, though currently low consumer awareness. Atlantic Sapphire product attributes include delicious taste (mild, delicate and versatile for cooking), sustainability (reduced logistics carbon footprint), eco-friendliness (reduced impact on the ocean environment), all-natural (free of antibiotics, hormones, pesticides and PCBs) and locally produced (Fresh from Florida, USA).Atlantic Sapphire has already been recognized by Oceanwise™ and Seafood Watch as “best choice.” Target market opportunities include high-end as well as sustainability-oriented restaurants and retailers, along with historically non-traditional channels such as online retailers and the U.S. military. Atlantic Sapphire will participate in leading the industry to a more sustainable future, increase the company’s consumer brand awareness, push new product and packaging innovation, and drive U.S. consumption per capita.

https://www.aquaculturealliance.org/advocate/developments-closed-containment-technologies-salmonids-part-2/

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Steven Summerfelt, Ph.D.

The Conservation Fund Freshwater Institute

1098 Turner Road

Shepherdstown, WV 25443 USA[103,114,111,46,100,110,117,102,110,111,105,116,97,118,114,101,115,110,111,99,64,116,108,101,102,114,101,109,109,117,115,115]

Tagged With

Related Posts

Innovation & Investment

Competitiveness comes at scale for RAS operations

Total RAS salmon production worldwide is less than half of 1 percent of total production. Many of the investors flocking to the sector now are new to fish farming, and confident in its potential.

Innovation & Investment

Polish RAS salmon farm mixes modern technology with ancient water

Jurassic Salmon, established in Poland just two years ago, is using 150-million-year-old geothermal saline waters from the “Lower Jura” era. Armed with certifications, the company is navigating an awkward growth stage.

Intelligence

Norwegian land-based salmon farmer finds Maine open for business

Nordic Aquafarms will be bringing something to Maine that’s new to the state: a salmon farm that operates on land. When complete, it will be one of the largest such facilities in the world.

Innovation & Investment

Getting proficient in RAS fundamentals

A number of large salmon farming companies are now investing significantly to increase land-based, water recirculating aquaculture systems (RAS) in northern Europe and North America, and there is likely a need for more trained farm personnel to run and manage these and other close-containment aquaculture facilities.