Roller coaster ride to sustainable future?

As one of the most technologically advanced forms of aquaculture in the world, eel farming saw an initial rapid growth in production up to the early 2000s. In the past decade, however, the industry has been facing a series of challenges that could damage its future outlook. Farmers are now striving to find new ways to secure the future of European eel production in a more sustainable way.

Industry development

The first eel ponds were established in Italy in the early 1970s, following Japanese examples. These farms were stocked with small wild-caught eels, which were allowed to grow to sizes often exceeding the 2-kg size prized by the local market. In the 1980s, the first indoor, technologically advanced recirculating farms were established, allowing year-round temperature-controlled culture, even in the colder climates of northern Europe.

The controlled conditions of the recirculating farms allowed them to make use of the glass eels that arrived at European coasts in large numbers each winter and spring. Farmers perfected techniques to achieve very high survival rates of the delicate stocking material. Next to wild fisheries, these farms became an increasingly important supply for the markets that considered eels a traditional delicacy throughout Europe.

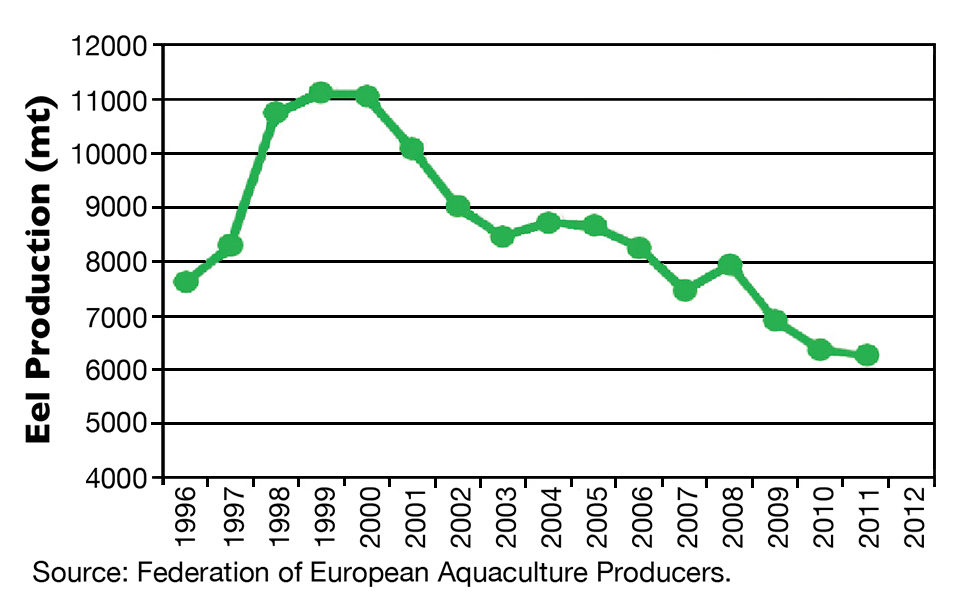

The high prices paid for eels led to a rapid increase in the number of farms in the mid-1990s, but by 1999, the increase in production, together with increased imports from Asia, resulted in overproduction (Figure 1). Prices dropped below production costs.

Issues

In 2002, imports from China were banned due to the presence of chemical residues, and the demand for eel fillets from supermarkets helped push eel prices back to a profitable level. Nevertheless, the decreased financial reserves of the farms due to the low prices in previous years took their toll.

In the following years, the exploding production in China and the lack of Japanese glass eels increased demand for the shrinking supply of European glass eels. Skyrocketing glass eel prices put additional strains on the financial position of the farms. Production started to decline with an increasing number of farmers unable or unwilling to take the financial risks of continued operation.

The situation for the eel industry got even more difficult by the mid-2000s. It was clear that the number of glass eels arriving at European coasts declined significantly since the 1980s. Due to the complex nature of the eels’ life history, a clear reason for the decline could not be given, but climate change, diseases, pollution, overfishing and – most of all – lack of access to and from the natural freshwater habitat were all speculated to contribute.

Regulatory action

As a result, the European eel was placed on the CITES Appendix II in 2007. Although trade is still allowed within the regulations of the Convention on International Trade in Endangered Species of Wild Fauna and Flora, supermarkets in the main eel consumer markets like Holland, Germany and Denmark were pressured by non-governmental organizations to stop selling eels.

The result was a second wave of farms going out of business. China again exported large amounts of eels to the European markets at low prices. The European Union adopted a regulation in 2007 to establish measures for the recovery of the European eel stocks, but without clearly defined measures, the farmers feared that glass eels would be either inaccessible or unaffordable in the future.

Some relief finally arrived in 2009, when all E.U. countries adopted national eel management plans for the recovery of the eels. The importation of consumption eels was stopped, and the exportation of glass eels was reduced and later phased out. By this time, eel production had been reduced significantly, but was regaining balance in consumption and pricing. The future looked brighter again.

Over the past decade, the eel industry has been supplying small eels for restocking, mainly in Germany and northern countries where water temperatures are too low to stock glass eels during the glass eel season, or glass eels cannot be stocked without a quarantine period. These restockings have shown a positive effect on the local eel populations.

To survive, the eel industry has come to the realization that it will have to increase its restocking efforts, either by itself or as part of the national eel plans, and take additional measures to help the recovery of the eels.

Industry initiatives

Several industry initiatives have been launched. In 2010, the Sustainable Eel Group (SEG) was founded by a group of scientists, conservationists and people with a commercial interest in eels to take practical action to accelerate the recovery of glass eels. SEG takes a leading role within the E.U. to promote the recovery of European eels and look for more sustainable ways of operating the eel industry.

To help achieve these goals, SEG scientists and conservationists developed sustainability standards for eel production. In the past year, some 75 percent of the European eel farms and processors were independently assessed. The next step is assessment of the glass eel fisheries.

The pilot standards are to be revised during 2013 as new insights in the eel recovery become available and lessons emerge from the pilot phase. The overall aim is for the industry, scientists and conservationists to work together for the eels’ recovery.

In Holland, the country with the greatest production and consumption of eels, eel fishermen, farmers and processors have formed a Dutch sustainable eel foundation, DUPAN. The organization aims to substantially contribute to the Dutch national eel plan to accelerate and exceed its goals. DUPAN supports activities ranging from restocking of eels and transfer of mature eels over the dikes to the sea, to education and research supporting recovery initiatives.

The organization raises a substantial amount of money from sales of eels that carry the label of the Sustainable Eel Fund, government grants and donations. DUPAN is now considered the leading authority on the private eel sector in Holland and is also active internationally as one of the members of SEG.

Perspectives

To achieve sustainability, the eel industry will have to reach a zero negative impact on the wild eel population. The impacts of catching glass eels can be reduced by selecting eels from areas with low natural survival. They can be further offset by supporting stocks in areas with good survival through restocking.

Natural recruitment can be improved by transporting mature eels from areas from which they would normally have little chance to migrate to the ocean for spawning due to dams and power stations. In addition, measures are being taken to minimize losses during capture, transport and culture, and to safeguard the well-being of the eels in farming conditions.

Eels have been part of the culture of Europe as a traditional delicacy. In Holland, smoked eels are as much part of its heritage as windmills, tulips and wooden shoes. The ultimate goal of the eel industry in Europe is to be able to continue to deliver eels to the table, but at the same time to contribute to the recovery of the European eel population. Without a wild eel population, the eel industry will not survive, and a positive future will be a benefit for both.

(Editor’s Note: This article was originally published in the July/August 2013 print edition of the Global Aquaculture Advocate.)

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Dr. Joost Blom

Sales Manager

Biomar A/S

Mylius Erichsensvej 35

DK-7330 Brande, Denmark[107,100,46,114,97,109,111,105,98,64,98,111,106]

Tagged With

Related Posts

Health & Welfare

A holistic management approach to EMS

Early Mortality Syndrome has devastated farmed shrimp in Asia and Latin America. With better understanding of the pathogen and the development and improvement of novel strategies, shrimp farmers are now able to better manage the disease.

Responsibility

A look at unit processes in RAS systems

The ability to maintain adequate oxygen levels can be a limiting factor in carrying capacities for RAS. The amount of oxygen required is largely dictated by the feed rate and length of time waste solids remain within the systems.

Health & Welfare

Advice for managing predatory birds, part 1

Predatory birds can cause major losses for tilapia farms. As some bird species are protected by law, fish farmers must use non-lethal control techniques.

Responsibility

Ailing waterways hail the oyster’s return

The Lower Hudson Estuary and Chesapeake Bay, two waterways once home to thriving oyster beds, would welcome the shellfish’s return. Aquaculture initiatives in both areas aim to reinvigorate the water and the communities they support.